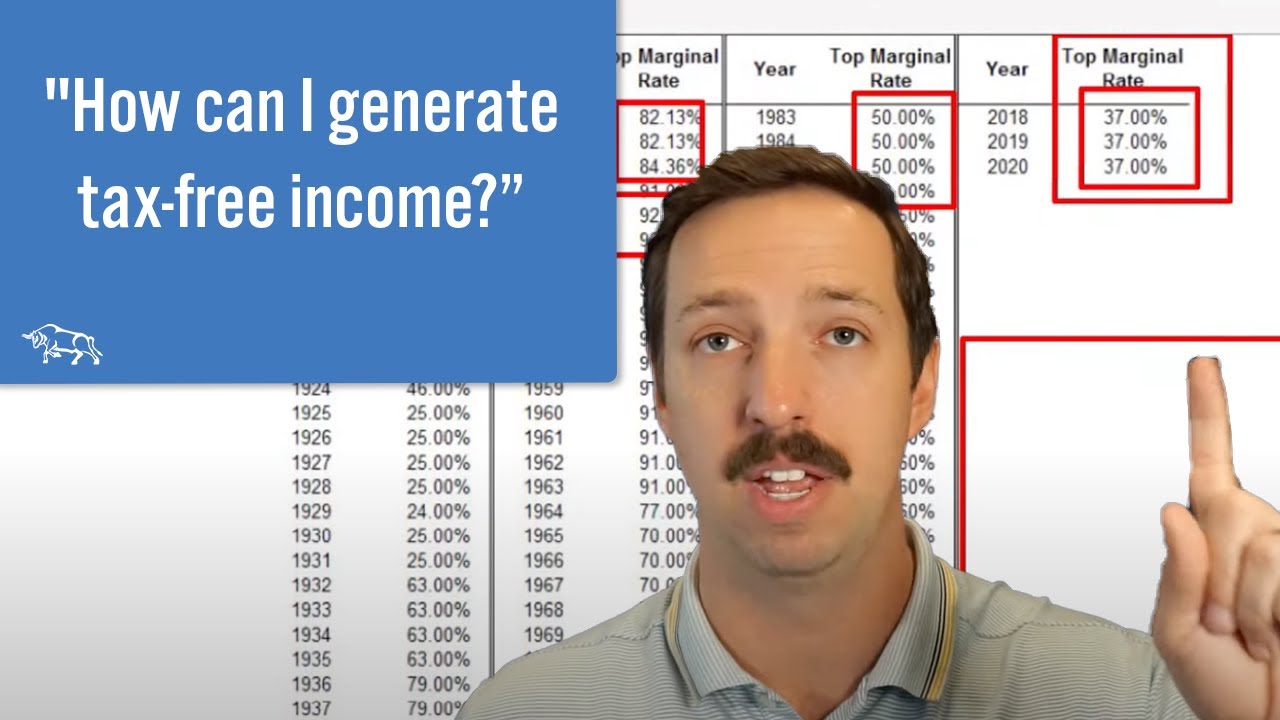

Tax Free Income For Life. David mcknight is the author of four #1 amazon bestselling books, the power of zero, look before you lirp, the volatility shield, tax. David’s book first discusses how the two biggest risks a retiree will face are tax rate risk and longevity risk.

In budget 2025, the rebate under the new tax regime has been increased; He or she seeks to take advantage of the numerous deductions allowed by.

TaxFree for Life by David McKnight Audiobook, He or she seeks to take advantage of the numerous deductions allowed by.

TaxFree for Life by David McKnight Audiobook, Tax benefit of ₹46,800 is calculated at highest tax slab rate of 31.2% (including cess excluding surcharge) on life insurance premium u/s 80c of ₹1,50,000.

TaxFree For Life General Overview YouTube, The returns that you get are completely guaranteed and insulated from all kinds of market.

How to Create TaxFree for Life with David McKnight YouTube, It has to be noted that the deduction limit under section.

A Closer Look at Using Life Insurance for TaxFree in Retirement, Tax benefit of ₹46,800 is calculated at highest tax slab rate of 31.2% (including cess excluding surcharge) on life insurance premium u/s 80c of ₹1,50,000.

Stream Download pdf TaxFree for Life A StepbyStep Plan for a, Mcknight shows how the combination of guaranteed, inflation.

Tax Free for Life Birdseye Financial, Such amount also includes the sum allocated in the form of bonus on such policy.

How to Create TaxFree For Life W/Your Roth Solo 401k with, Step 1:visit income tax calculator online on max life insurance.